The Affordable Housing Levy is a statutory deduction introduced to fund the government’s Affordable Housing Programme. While this deduction is not applicable to every tax-paying Kenyan, all employers and employees are mandated to make a 1.5% monthly contribution to the program. However, certain groups such as the self-employed, pensioners, and a few others are exempt. For those in formal employment, there is no option to opt out, leaving employees without a say on the deductions taken from their monthly income.

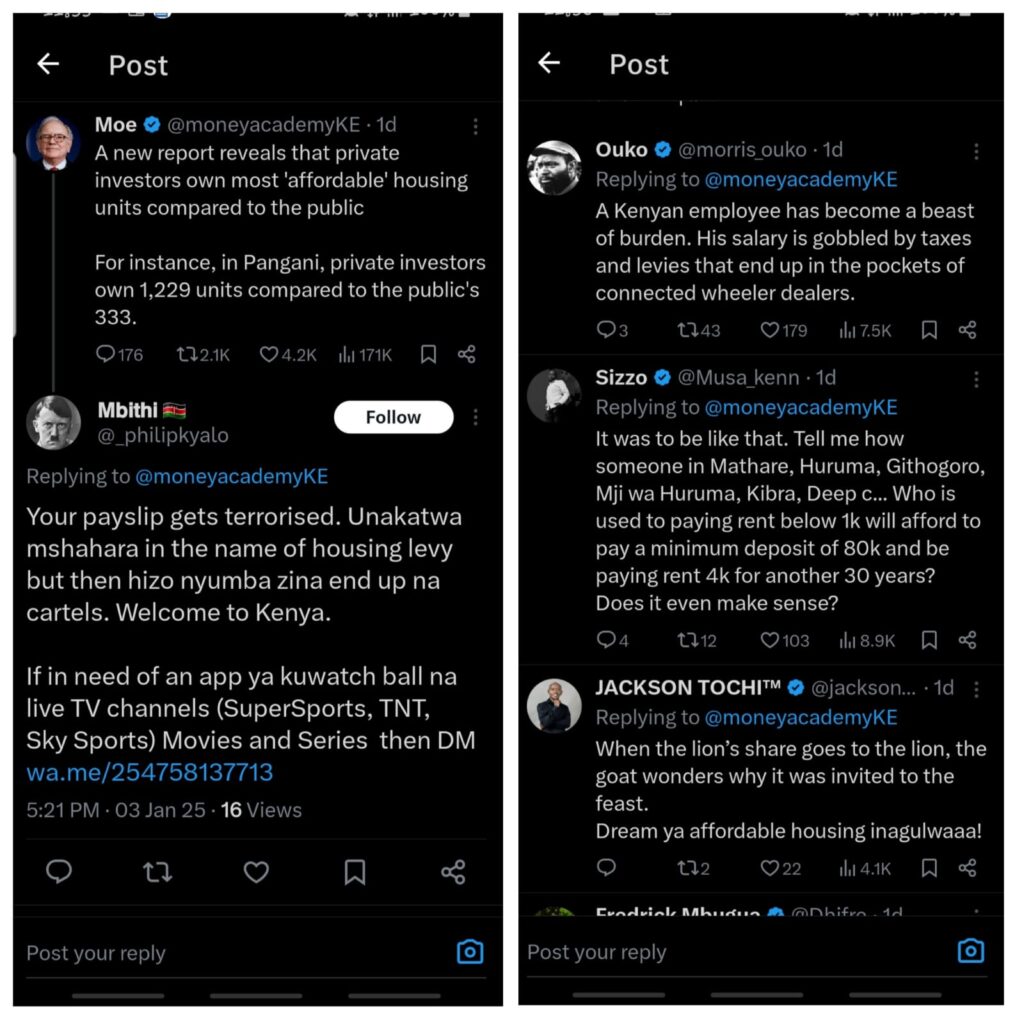

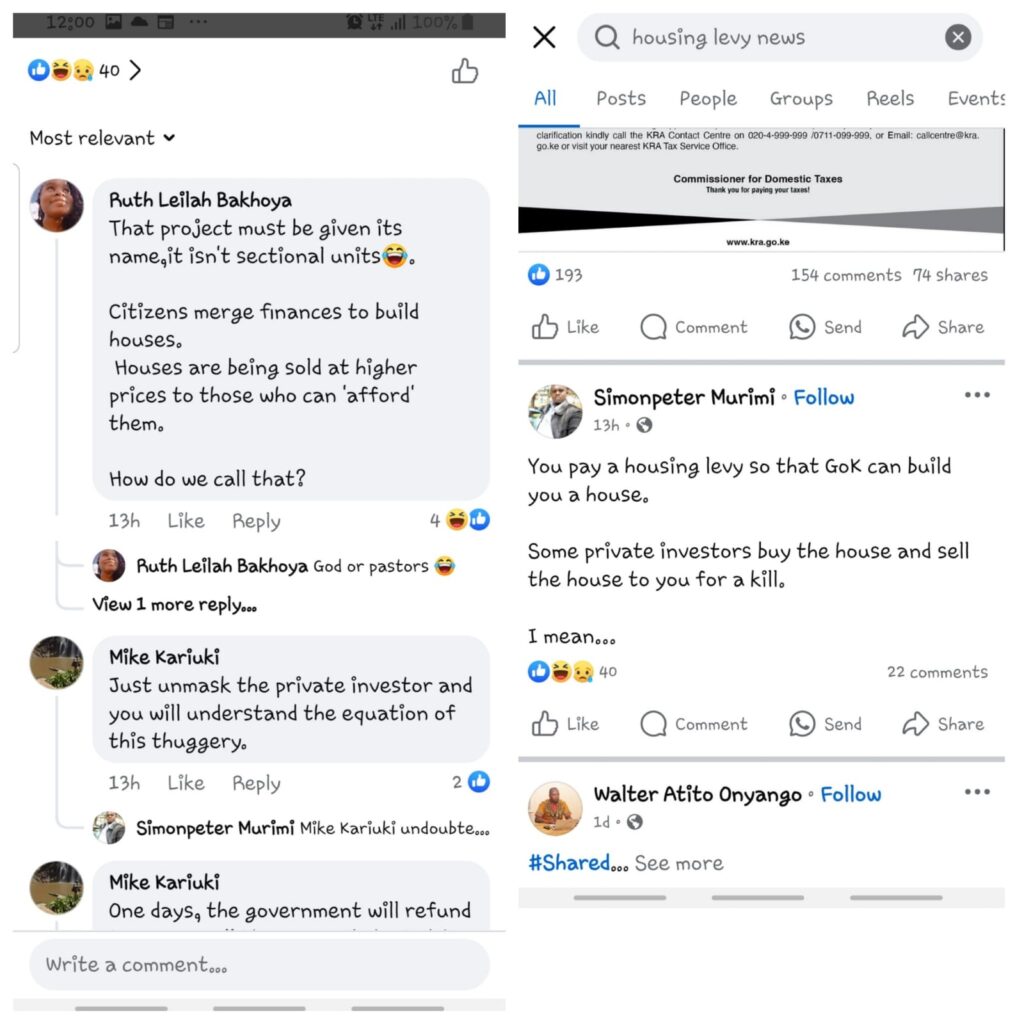

This levy has sparked significant public outcry, with many Kenyans taking to social media to voice their dissatisfaction. One of the most contentious issues is the perception that contributors are funding housing projects they may never directly benefit from while still having to pay rent for their current accommodations.

Adding fuel to the fire are reports that private investors have purchased houses within the Affordable Housing Programme for purposes of leasing and selling. This raises important questions about the true beneficiaries of the initiative and whether it fulfills its intended purpose of addressing the housing needs of low- and middle-income earners.

Is it fair to ask Kenyans to contribute to a program that might never benefit them directly? Shouldn’t there be more transparency regarding who these private investors are and how they influence the housing program? Without clear accountability and assurances that the program’s benefits will reach the intended population, many are left wondering whether the Affordable Housing Levy is truly a wise investment or just another financial burden on already strained households.